By Dr. Alain Dupas and Gerard Huber

One of our regular contributors and his co-author have addressed the strategic shifts accompanying technological change in the first part of the 21st century. In a major book published in France earlier this year, Dupas and Huber address the strategic impact of new technologies on the human condition. The book is entitled La grande rupture? L’humanité face à son futur technologique and was published by the noted French publisher Robert Laffont.

Chapter seven of the book addresses the impact of 21st century technological change on geopolitics. The translation of the first part of this chapter has been made by the Second Line of Defense staff and is published with the permission of the authors and the publisher.

***

The last chapter described one of the positive changes in world affairs: the emergence of a type of “international governance,” created to solve global issues such as pandemics, climate change, and the fight against arms proliferation. We see this in how countries have come together, at the G8 or the G20 level, to manage the financial and economic crisis and to move toward the implementation of strict regulations for banks and their traders.

The Return of the “Nation-State”

The fact remains, however, that in 2010 the “nation-state” is still the fundamental actor in major political, strategic, economic, and social decisions. This fact is contrary to the impression prevalent in the 1990s among liberals after the fall of the Soviet Union and the related reduction in international tensions.

The concept of a “new world order” has been brought forward, with some hope that the “peace dividend” could be used (i.e. savings from military budget reductions) to invest in the future and to help global economic development. Some economists even predicted the disappearance of the “nation-state,” opening the way to world government, and allowing for a greater role for “regions,” some of them spanning several countries (for example, a greater Catalonia region between France and Spain), as well as for private companies, pursuant to a philosophy inspired by Thatcher and Reagan.

Regional conflicts (the Balkans, Middle East, Africa), terrorist attacks, and more recently the financial crisis have led to the absolute opposite result. The “nation-states” have taken over an even greater role, with desperate interventions in 2008 and 2009 to “save” banks and national economies, with surprising actions such as the nationalization of the automotive companies by the U.S. government.

The conduct and result of their discussions depend, of course, on their respective economic power, but also on political influences, and more generally, on the perception, worldwide, of their power. Within the perspective of profound changes that are considered in this book, one question remains: how will the “power hierarchy” change in the decades to come, especially with the acceleration of scientific and technological discoveries?

The European Paradox

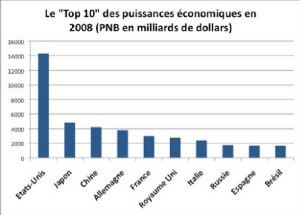

In 2008, the list of economic powers still included the developed countries, where the United States retained its wide lead, followed by Japan, a country often currently underestimated in importance, despite the fact that it was recognized in the 1980s as the greatest competitor to the United States and Europe.

Currently China is in third place, ahead of Germany and the main European countries. Why, though, does the European Union not appear on this list? With a cumulative GNP of over $18 billion, it should easily be in first place. The problem is that the European Union is not an integrated federal state, like the United States, but rather a “common market,” with free circulation of goods, people, and assets within a regulated and coordinated setting.

The EU budget represents only about 1% of the wealth of its 27 members, which manage about 99% of GNP at the national level. Of course the EU has institutions such as the European Council, the European Commission, the European Parliament, etc., which coordinate policies to a degree underestimated when one considers only the 1% share referred to above. For now, however, Europe is not considered as an entity to be dealt with as a whole, whether by its partners or its competitors. Communications from Washington, Moscow, and Beijing are more likely to be with London, Paris, or Berlin, rather than with Brussels. It is also difficult to understand the subtleties of the EU organization.

Will the Lisbon Treaty, if ratified, signify an improvement that will give the EU a greater role on the international scale with a clearly identified president? One would hope so, because short of a change toward greater integration, how much weight will each individual country have in the year 2050?

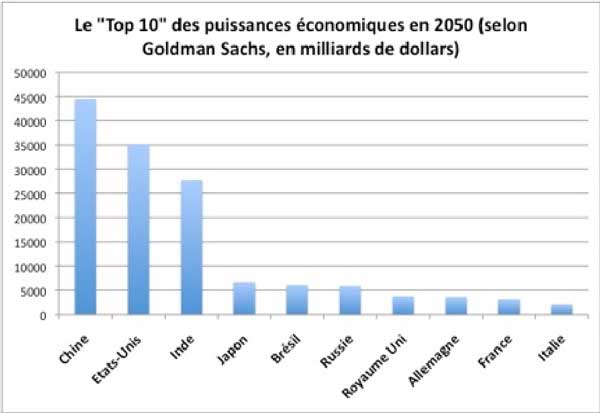

This question, and more generally the question of the hierarchy of national wealth, was brought to the forefront of current events in 2003, with an article published by one of the largest investment banks in the world, Goldman Sachs, on the evolution of the GNP of the great powers in the coming decades.

The Rise of “BRIC”

The Goldman Sachs study created an acronym that has since come into popular use: “BRIC” (standing for Brazil, Russia, India, and China), four countries whose wealth should increase, according to the economists at Goldman Sachs, much faster than that of developed countries, and lead to a profound revolution in the hierarchy of world GNP by 2050.

The figures in the graph above are projections from the 2003 article. They have since been amended, and the consequences of the current crisis will further affect them (it is estimated that the world GNP decreased 3% in 2009). The Goldman Sachs projections, however, have shaken up the international community and the media: China, the richest country in the world by 2050? The United States toppled? India, a surprising third on the podium, leaving Japan far behind? Japan, followed closely by Brazil and Russia? The European countries becoming “economic midgets” led by Great Britain, relegated to seventh place? France reduced to ninth? A true “break” predicted in the world order…

An Alliance of Russia, India, and China Against the United States?

These predictions seemed incredible. They were, however, present in the economic data which, year after year, showed very intense growth in China and India, with rates often near or above ten percent…. Sustained growth translated into an exponential increase of the GNP, which could be spectacular and lead to huge gaps between countries in a few decades.

It is true that the Goldman Sachs study is based on the conceptualization and simulation of economic evolution, and it is important not to confuse the results of computer simulations of the future with current reality. It is also true, however, that such predictions can be useful in identifying trends.

The “Top 10” Economic Powers in 2050, according to Goldman Sachs, in millions of dollars (Credit Graph: Alain Dupas and Gerard Huber)

Here the trend is clear: China and India, which were major economic powers until the 18th Century, are in good position to regain their domination by the year 2050. According to Goldman Sachs, the two other BRIC members, Russia and Brazil, are also on a rising trajectory, but less rapidly, which should enable them to catch up with Japan in a group of three “chasers,” to use cycling lingo, ahead of the “pack,” at the head of which we find the European nations, which are divided at the moment.

Does the BRIC concept have any meaning beyond the simultaneous rise in position of wealth in the world? Brazil, Russia, India and China have little in common with regard to culture, resources, political regimes or aims. This did not prevent them from meeting in June 2009 for the “BRIC Summit,” organized by Vladimir Putin in Russia. Will this meeting have a follow-up, which could mark the creation of some kind of “bloc,” allowing all four countries to have greater weight on the international scene? Considering the diversity of their interests, the chance of this happening is doubtful. There are also other countries, left out of the initial Goldman Sachs study, that will rise in the world hierarchy. The U.S. investment bank also came up with a new concept: the N-11 (or “Next Eleven” or Bangladesh, Egypt, Indonesia, Iran, Mexico, Nigeria, Pakistan, the Philippines, South Korea, Turkey, and Vietnam).

According to Colin Gray, a respected Anglo-American strategic expert, the only alliance on the geopolitical scene in the 21st Century that might be a serious contender to the United States would be a regrouping of China, India, and Russia, the three Eurasian BRIC countries. These three nations complement each other somewhat: Russia could contribute its military technology, inherited from the former Soviet Union, which remains very advanced, as well as natural resources; India’s scientific and technological community ranks very high and leads in computer science and its labor force is both qualified and cheap; China is able to mass produce cheaply and has huge financial reserves at its disposal.

Is reconciliation among these three powers truly possible? Colin Grey thinks so, and believes that it could lead to a new “cold war” between an American camp (along with Europe and Japan?), and the new Eurasian “triple alliance.”

Factors in the “Power Equation”

Is the Anglo-American strategist right? His most interesting point is that a true competitor to the United States could only emerge in the 21st Century by combining the capacities of several emerging powers, which underscores another interesting fact: the power of one state is not measured solely by its economic power. It could be a “cocktail” of several elements, such as GNP (symbolizing economic and financial strength, where China and India would excel), demographics (significant in India), military power (which remains strong in Russia), ambition (important in Russia and on the increase in China), and, increasingly, innovation (an area where India is improving quickly), in our opinion.

Should one of the factors in what we like to call the “power equation” be absent, the international position of a country is necessarily reduced. This is the major problem with the European power: it lacks an integrated military capacity. The strength of the United States, by contrast, is outstanding for every cited factor.

China and India, whether allied or not, would perhaps pose a problem to the United States as global powers approaching the year 2050, and possibly to a united Europe. In the shorter term, it is more likely that their rising economic power could threaten the prosperity of the current great powers and other industrialized countries, such as Canada, Japan, South Korea, Israel, and Australia, with low cost production and higher quality, strategic relocation, etc. What will the advanced countries be able to do in the face of this competition? And in the face of many N-11 countries that will be even more competitive?

The Key to Future Growth in Advanced Countries: Innovation in the NBICs

The very advanced countries, such as the United States and the large European nations, can indeed retain two essential closely related advantages. The first is at the core of the set of issues that this book addresses: the dominance in the rapidly evolving fields of the “NBICs”: nanotechnology, biotechnology, information technology, and cognitive technology. The scientifically advanced countries will first be able to develop future products and services in these four converging areas, which involve new ways to use the internet, 3D cinema, virtual reality systems, and multi-purpose mobile terminals; in short all the tools of what we call “the extension of the domain of change.” This, however, involves constantly augmented research efforts as well as an economic and social culture favorable to innovation, the “Holy Grail” of the 21st Century…

(On BRIC consumers see http://blogs.ft.com/beyond-brics/tag/consumer-special/)

———-

***Posted on August 17th, 2010