Originally published in Manufacturing and Technology News, May 17, 2011

By Charles McMillion, President, MBG Information Services, Washington, D.C.

06/06/2011 – The United States continues to lose production in the global economy, according to the first quarter 2011-trade figures for goods and services released by the Census Bureau on May 11.

The first quarter trade deficit in goods and services is 23.5 percent worse than during the first quarter of 2010 and is 20.4 percent worse than during the last quarter of 2010. The dollar value of U.S. export growth remained near stagnant in the first quarter of 2011 (declining in February), while the value of imports accelerated sharply — largely due to higher prices for oil and other commodities.

The trade deficit for U.S. goods and services for March suggests that worsening net loss of production to global trade reduced GDP growth rate in the first quarter by more than the modest -0.1 percent cut that the Bureau of Economic Analysis initially projected.

The auto sector suffered a $10.4-billion trade deficit in March and, after $1.3 trillion in trade losses since the year 2000, appears to face a loss of at least an additional $125 billion in 2011.

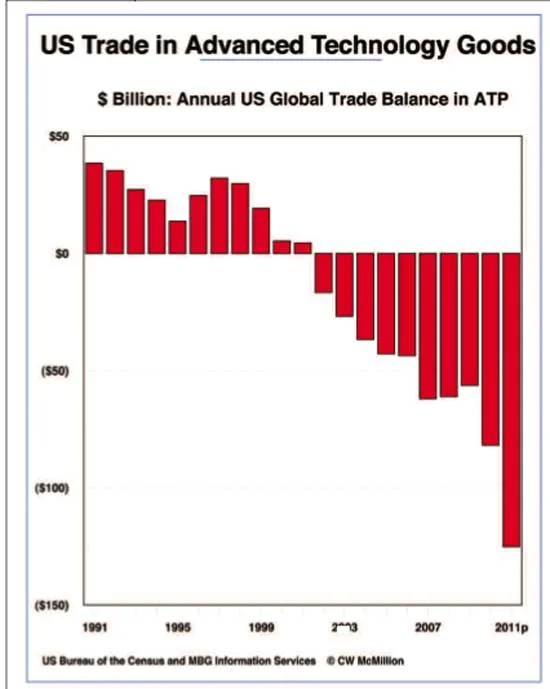

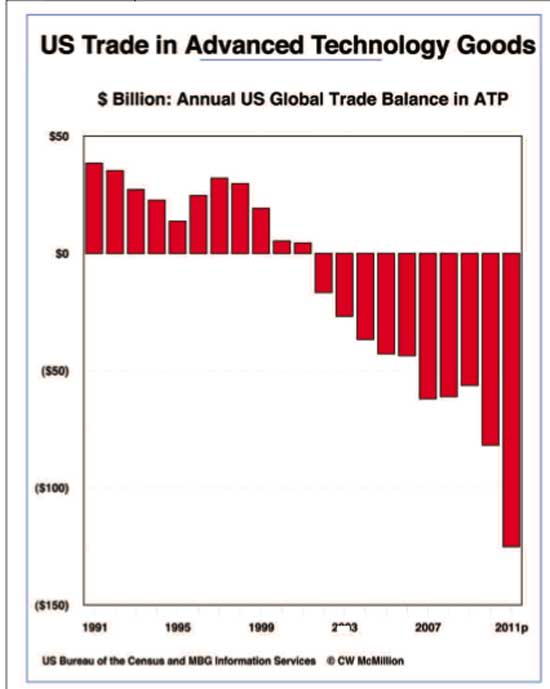

But the big news in the trade report is the continuing worsening of U.S. trade losses in Advanced Technology Products (ATP), which are now 66 percent worse in 2011 than the record-setting pace of losses in 2010. Exports of advanced technology products are up only 3.8 percent year over year, while imports are up 13.5 percent.

Losses in advanced technology products always accelerate from June-to-November, but even if year-over-year losses moderate later this year, it seems reasonable to expect an annual 2011 deficit of at least $125 billion compared with last year’s record $81.8 billion in ATP losses.

Imports from China continue to account for more than the entire U.S. ATP deficit, but there are other interesting changes: so far this year the United States has ATP surpluses with NAFTA partners but deficits with Europe.

It is important to note that all foreign-earned Intellectual Property (royalties and fees) revenues of “U.S.”-Incorporated firms such as Apple, Microsoft and Starbucks, declined in the first quarter of 2011 compared to the same quarter in 2010, as did the total IP revenue in the U.S. of foreign incorporated firms. As a result, the U.S. surplus in IP is virtually unchanged over the year, and remains far less than the ATP deficit.

The unprecedented decade-long U.S. trade deficit in combined technology goods and IP is worsening very sharply in 2011. The March trade statistics are located at http://www.bea.gov/newsreleases/international/trade/2011/trad0311.htm.